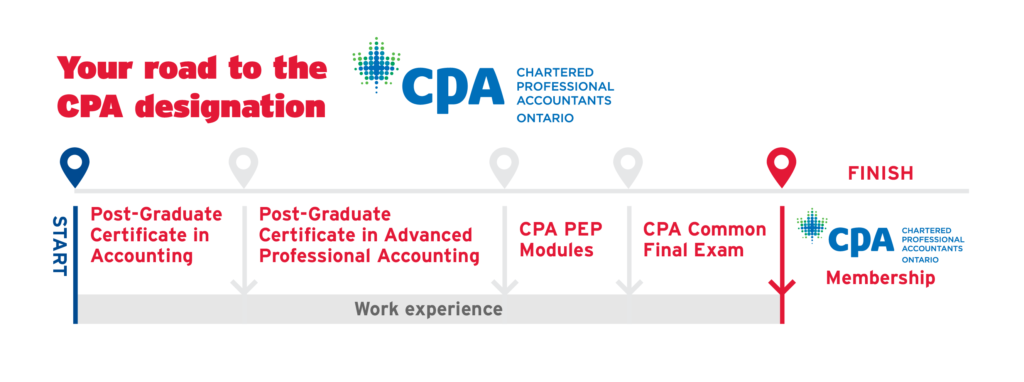

Begin your journey to earning a valuable CPA designation. Establish a solid accounting foundation and the professional skills required to pursue your full career potential, from entry-level roles to managerial positions down the line.

What you will learn

In our Post-Graduate Certificate in Accounting, you will gain a comprehensive understanding of the accounting field. Through the guidance of expert instructors, this program will help you:

- Develop a foundational set of accounting and data analytics principles through experiential assignments and projects

- Hone your data visualization skills by learning how to interpret financial and non-financial information

- Further develop your cross-functional skills like critical thinking, communication, and management

- Start to prepare for CPA Professional Education Program (PEP) courses to become a Chartered Professional Accountant (CPA)

Program Benefits

- Gain relevant and in-demand accounting knowledge with a curriculum co-designed and taught by senior industry executives

- Learn how to evaluate and analyze key data points to support business decisions

- Advance through the program with the same peer group and build professional relationships that extend beyond the program

- Engage in experiential assignments and apply your knowledge towards real-world business challenges

- Complete the program in less than one year