Build on your accounting and data analytics skillset in this program which encourages agile and connected thinking so you can pursue career advancement opportunities and prepare to earn a CPA designation.

What You Will Learn

In this full-time Post-Graduate Certificate in Advanced Professional Accounting, you’ll explore advanced accounting topics in areas such as auditing, taxation principles, data analytics and accounting information systems. This program will also help you:

- Develop an advanced accounting skill set through experiential assignments and projects

- Identify, analyze interpret relevant data for decision making purposes

- Understand organizational risk with regards to data, data privacy and data security

- Hone cross-functional skills such as critical thinking, business acumen, problem solving and communication

- Practice key management and leadership techniques

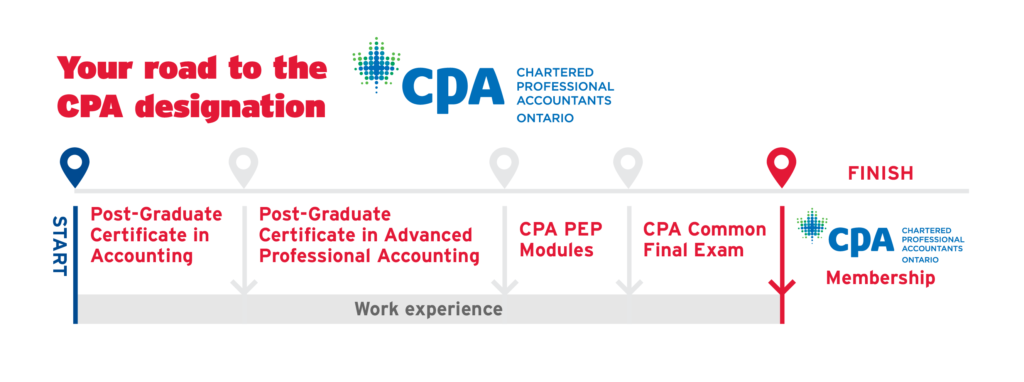

- Prepare for CPA Professional Education Program (PEP) courses to become a Chartered Professional Accountant (CPA)

Program Benefits

- Gain relevant and in-demand accounting knowledge with a curriculum co-designed and taught by senior industry executives

- Learn advanced Excel and PowerBI skills

- Advance through the program with the same peer group and build a professional network that extends beyond the program

- Engage in experiential assignments and apply your knowledge towards real-world business challenges

- Complete the program in 9 months of study