Information Session, Webinar

We use cookies to deliver the best possible experience. By using our website, you're agreeing to our use of cookies.

Elevate your accounting expertise and maximize the long-term success of your accounting career

Select an Offering to Register

Note: International students must pay through Convera GlobalPay.

Dates

Fall 2025

-

Delivery Format

Online

(Self-study)

Type & Length

Part-time

22 months

Tuition

$7,317 (Domestic)

Dates

Winter 2026

-

Delivery Format

Online

(Self-study)

Type & Length

Part-time

22 months

Tuition

$7,317 (Domestic)

In this part-time, 100% online Post-Graduate Certificate in Advanced Professional Accounting, you’ll prepare for success at every level of your career, from entry-level positions to senior managerial roles. This program will help you:

The Chartered Professional Accountant (CPA) designation is globally recognized and provides a wealth of opportunities to those who hold it. The mean average compensation of CPAs working in Canada is $151,000(CPA Ontario).

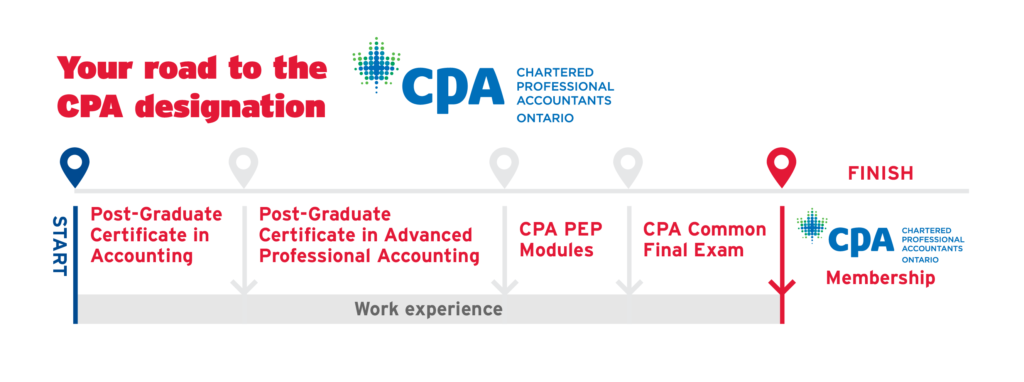

Both accounting certificates combined with your undergraduate degree will help you move on to the next stage of your CPA journey—the CPA Professional Education Program (PEP).

For a full list of our accounting courses and their respective CPA preparatory course equivalencies, please click here. For more information about pursuing the designation, please visit CPA Ontario | CPA Student Journey.

The Certificate in Advanced Professional Accounting is a direct registration program—no application process required. Simply enrol in the session of your choice.

While there are no formal admission requirements, you’ll find this program especially beneficial if you have:

Please review the technology and software requirements you will need to access our courses remotely.

Ask us anything about this program and we’ll get back to you within 2 business days.

Your journey to success begins with us. Learn how to apply today. If you have any questions, we're here to help guide you every step of the way.

Notifications