Build a solid foundation for the long-term success of your accounting career. In this fully online program, you’ll cover all the essentials of accounting and start working towards earning a valuable CPA designation.

What you will learn

Learn from expert instructors with experience in the accounting industry as you prepare to establish your career in this critical field. In our online Post-Graduate Certificate in Accounting program, you will:

- Develop a foundational set of accounting principles through experiential assignments and projects

- Hone your cross-functional skills like critical thinking, communication, and management

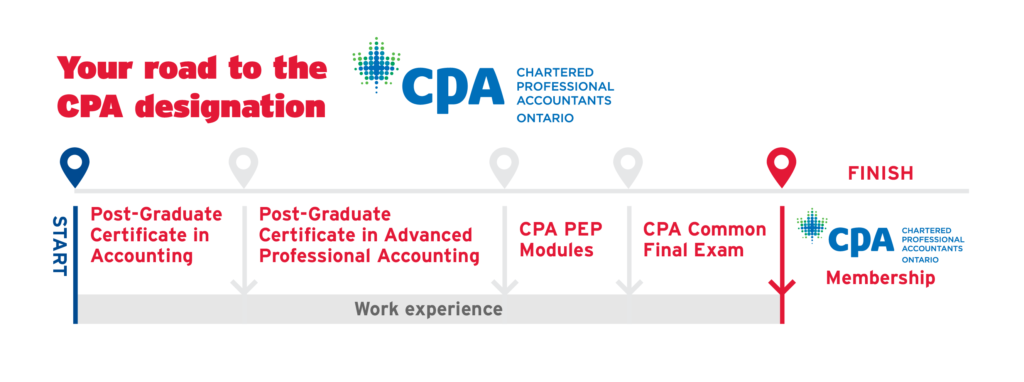

- Begin to prepare for CPA Professional Education Program (PEP) courses to become a Chartered Professional Accountant (CPA)

Program Benefits

- Gain relevant and in-demand accounting knowledge with a curriculum co-designed and taught by senior industry executives

- Complete the program in 18 months of online study, network virtually with instructors and peers

- Advance through the program with the same peer group and build professional relationships that extend beyond the program

- Engage in experiential assignments and apply your knowledge towards real-world business challenges